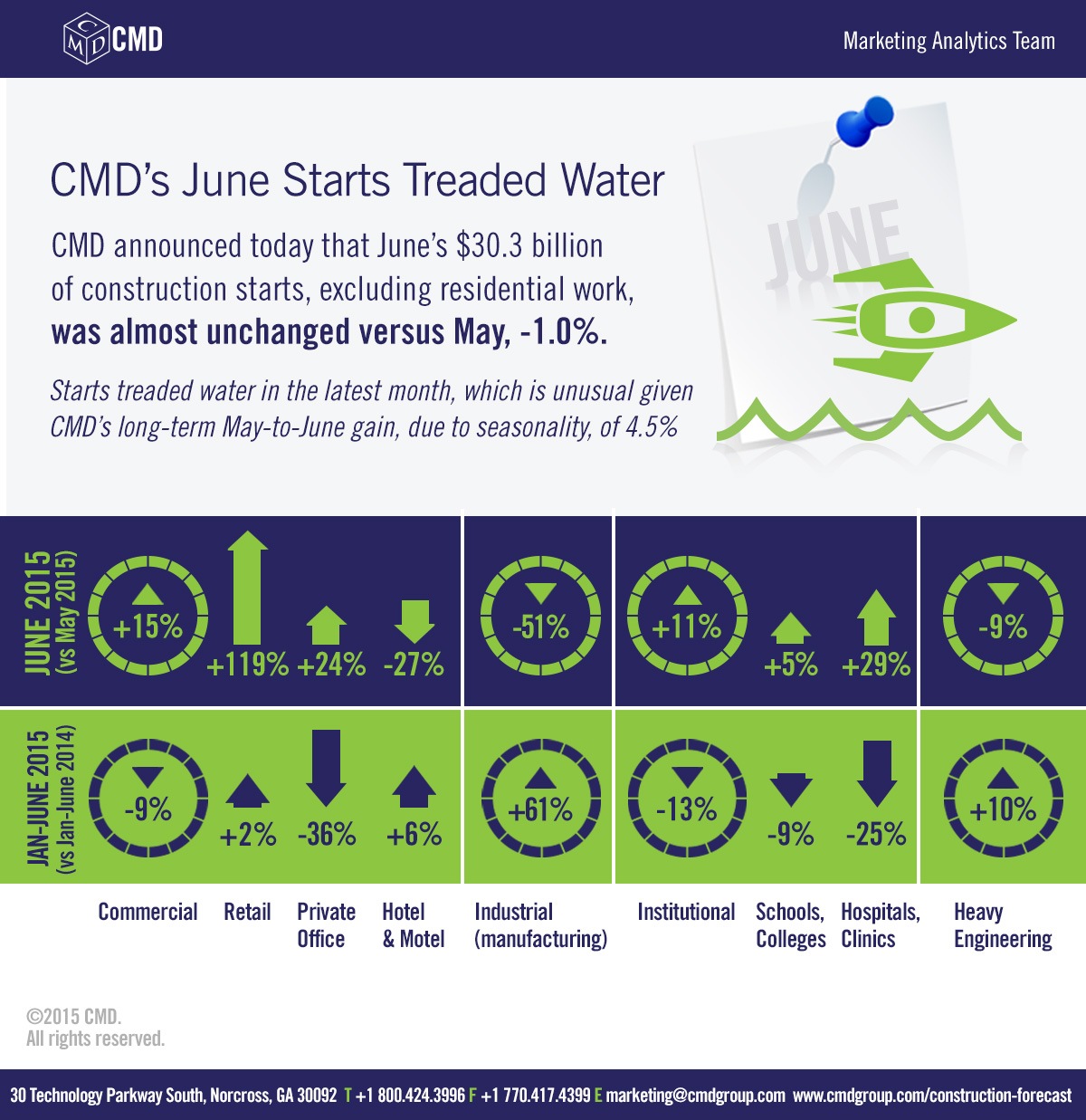

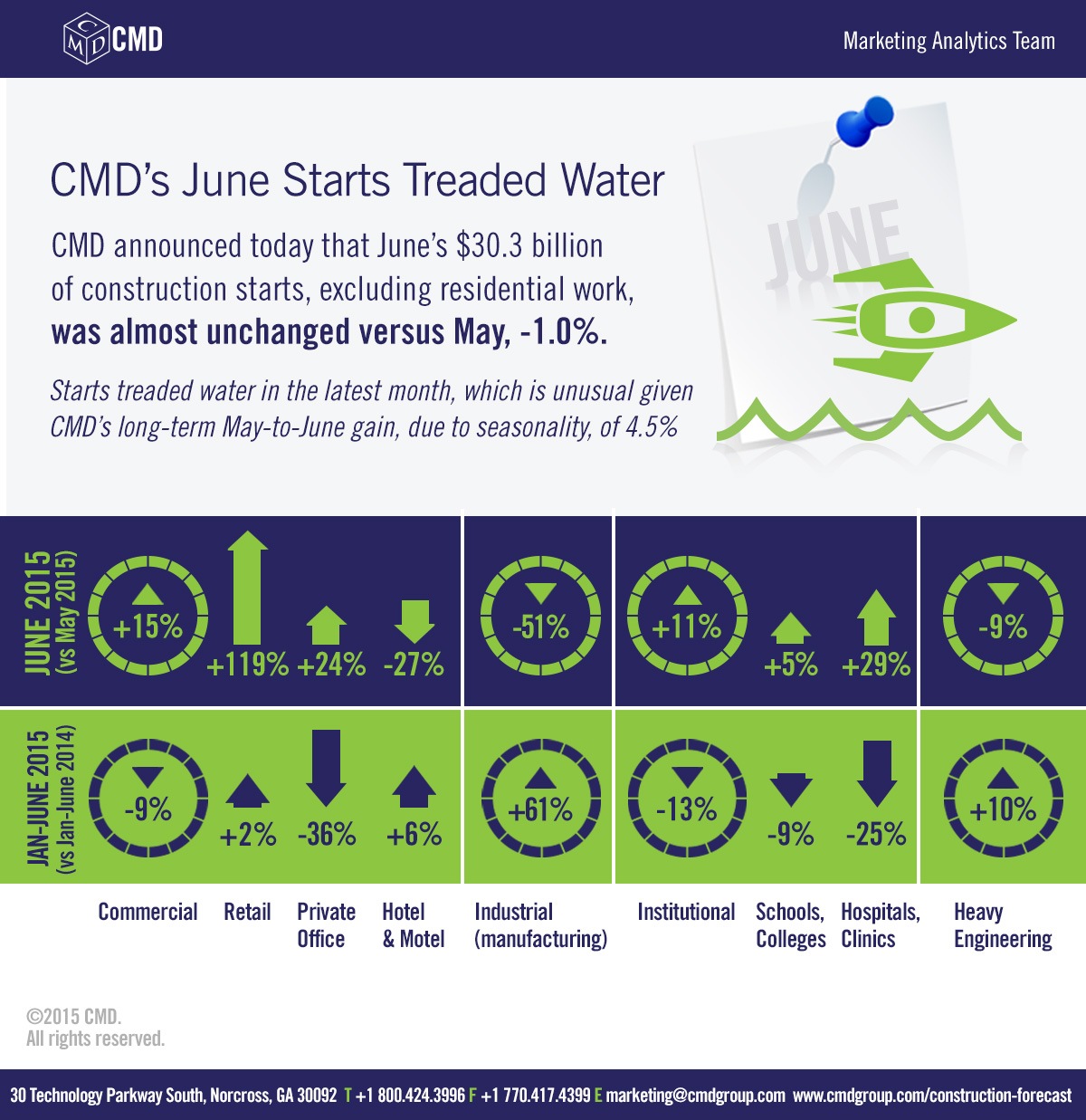

CMD Group recently announced that June's $30.3 billion of construction starts, excluding residential work, was almost unchanged versus May, -1.0 percent. Starts treaded water in the latest month, which is unusual given CMD's long-term May-to-June gain, due to seasonality, of 4.5 percent.

CMD Group recently announced that June's $30.3 billion of construction starts, excluding residential work, was almost unchanged versus May, -1.0 percent. Starts treaded water in the latest month, which is unusual given CMD's long-term May-to-June gain, due to seasonality, of 4.5 percent.

June's month-to-month inertia was a pause after May's extraordinary 37.3 percent leap. May included a couple of mega-sized project groundbreakings, the likes of which weren"t repeated in June.

Year-to-date starts in 2015 have also been -1.0 percent relative to the same January-to-June period of last year. Compared with its counterpart month last year, standalone June in 2015 was -4.8 percent.

"Non-residential building" plus "engineering/civil" work accounts for a considerably larger share of total construction than residential activity. The former's combined proportion of total put-in-place construction in the Census Bureau's May report was 63 percent; the latter's was 37 percent.

CMD's construction starts are leading indicators for the Census Bureau's capital investment or put-in-place series. Also, the reporting period for starts (i.e., June 2015) is one month ahead of the reporting period for the investment series (i.e., May 2015.)

According to the Bureau of Labor Statistics, employment in the U.S. construction sector also stayed flat in June relative to May. The year-over-year increase, however, has been a more-than-respectable 259,000 jobs. The first half of 2015 has contributed 105,000 net new positions.

Total non-farm employment nationwide has been +2.1 percent year over year. Construction's increase has been exactly twice as fast, +4.2 percent. The unemployment rate in construction is 6.3 percent (not seasonally adjusted), a decline of almost 2.0 percentage points from last year's 8.2 percent in the same month.

Before there can be onsite construction activity, projects must be contemplated and planned by owners and rendered into working drawings by design professionals. In June, the year-over-year rise in architectural and engineering services employment maintained a strong pace, +3.6 percent.

Month to month in June, the commercial (+14.8 percent) and institutional (+10.9 percent) type-of-structure categories recorded increases in starts. They were offset by engineering's decline (-8.5 percent).

Industrial starts also dropped, by half (-50.5 percent), but this category of work plays a smaller role in the total. There were no industrial project starts in June equivalent to the initiation of work on Tesla Motors" Nevada battery gigafactory in May, carrying an estimated value of $2.0 billion. Although, that's not to slight a $1.0 billion start on a methanol plant in St. James, Louisiana.

When this year's individual month of June is compared with the same month last year, the sub-category percentage changes are muted. Institutional work advanced (+2.6 percent), but the heavy engineering/civil work category declined (-1.1 percent), as did commercial (-2.2 percent).

The smaller category of industrial starts took a nosedive (-54.8 percent). Industrial percentage changes are often highly variable depending on the presence, or absence, of a large project or two.

With respect to year-to-date starts, heavy engineering (+10.2 percent) has been "riding point". Institutional (-12.9 percent) and commercial (-9.4 percent) have been less eager to keep up.

Industrial (+61.2 percent) year-to-date starts are a source of encouragement.

Within engineering starts, the biggest sub-category by far is road/highway work. In June, it was -4.1 percent month to month (m/m) and only +0.8 percent when compared with the same month of last year (y/y); but it was an expansive +14.4 percent through this year's first half versus last year's (ytd).

Next most important in engineering, water/sewage starts were also so-so in the individual month of June (+0.1 percent m/m and -4.9 percent y/y), but more promising on an accumulated basis (+6.2 percent ytd).

As for institutional, the year-to-date dollar volume of educational facility starts is five times greater than for healthcare projects. School/college starts in June were +5.3 percent m/m; -14.1 percent y/y; and -8.5 percent ytd. So far this year, in contrast to college/universities (-13.1 percent ytd) and junior/senior high schools (-20.2 percent ytd), elementary/pre-schools have been upbeat (+11.5 percent ytd).

Hospital/clinic starts surged in the individual month of June (+29.0 percent m/m and +79.6 percent y/y), but remained lower by one-quarter (-25.4 percent) year-to-date. The recent Supreme Court ruling to solidify the Patient Protection and Affordable Care Act provides more stability for investment decisions. Besides, employment growth in the healthcare field is a robust +2.9 percent year over year.

Retail starts in commercial work leapt forward in June (+118.8 percent m/m; +63.4 percent y/y; and +2.3 percent ytd), as did the miscellaneous commercial category (+10.7 percent m/m; +107.8 percent y/y; and +5.6 percent ytd). A major sub-component within the latter is sports/convention centers (+67.7 percent ytd).

Elsewhere in commercial, though, there were hiccups. Private office buildings may have been +23.5 percent m/m, but they were -42.3 percent y/y and -35.5 percent ytd. Government office buildings were -8.3 percent m/m; +6.8 percent y/y; and -18.6 percent ytd.

Among the 12-month moving average trend, the slope is moving impressively higher for roads/highways and more modestly upward for water/sewage and bridges. Private office buildings is the one category that has clearly been heading downwards.

According to June's Employment Situation report from the BLS, construction's average hourly earnings in June, at +2.4 percent year over year, modestly outpaced the gain for all sectors, +1.9 percent. Construction displayed a frothier advance in average weekly earnings, +2.9 percent versus +1.6 percent.

The value of construction starts each month is summarized from CMD's database of all active construction projects in the U.S. Missing project values are estimated with the help of RSMeans" building cost models.

Source: Alex Carrick, CMD Group.

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn!

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn! Search our job board for your next opportunity, or post an opening within your company.

Search our job board for your next opportunity, or post an opening within your company. Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.

Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.