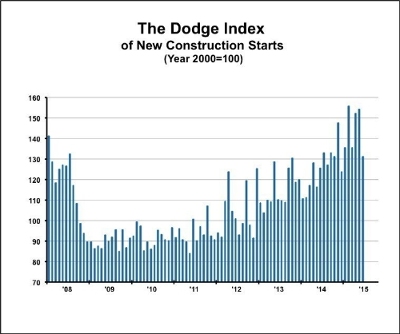

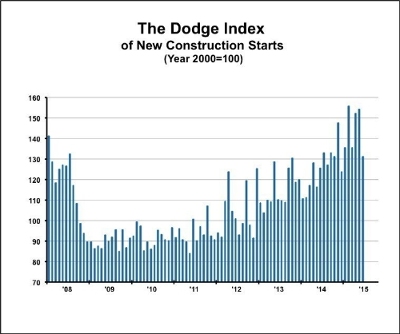

June’s data lowered the Dodge Index to 131 (2000=100), down from 154 in May. Through the first six months of 2015, the Dodge Index averaged 144, helped by especially strong readings in February, April and May which reflected the start of several massive projects in those months. June’s 131 for the Dodge Index is at the low end of what’s been reported so far in 2015, but it’s still above the 125 average for 2014 as a whole.

Nonresidential building, at $190.6 billion (annual rate), retreated 8 percent in June, as weaker activity was reported for the majority of the structure types. The commercial building group fell 13 percent following its 17  percent increase in May. Both stores and warehouses weakened in June, dropping 9 percent and 53 percent respectively, while hotel construction slipped 11 percent from its heightened May amount. Despite its May decline, hotel construction in June did see the start of several large projects, including a $411-million hotel resort in Lahaina, Haiwaa and a $97-million hotel in Charleston, South Carolina. Office construction in June ran counter to the other commercial structure types, advancing 11 percent from the previous month. Large office projects that reached groundbreaking in June were $575 million for the office portion of the $618-million Manhattan West project in New York, New York, a $202-million office building in Denver, Colorado and a $95-million office building on Roosevelt Island in New York as part of the Cornell NYC Tech Campus development. Manufacturing plant construction in June bounced back 86 percent from a weak May, and included such projects as a $600-million refinery expansion in Texas and a $200-million ethanol plant upgrade in Nevada.

percent increase in May. Both stores and warehouses weakened in June, dropping 9 percent and 53 percent respectively, while hotel construction slipped 11 percent from its heightened May amount. Despite its May decline, hotel construction in June did see the start of several large projects, including a $411-million hotel resort in Lahaina, Haiwaa and a $97-million hotel in Charleston, South Carolina. Office construction in June ran counter to the other commercial structure types, advancing 11 percent from the previous month. Large office projects that reached groundbreaking in June were $575 million for the office portion of the $618-million Manhattan West project in New York, New York, a $202-million office building in Denver, Colorado and a $95-million office building on Roosevelt Island in New York as part of the Cornell NYC Tech Campus development. Manufacturing plant construction in June bounced back 86 percent from a weak May, and included such projects as a $600-million refinery expansion in Texas and a $200-million ethanol plant upgrade in Nevada.

The institutional building group in June settled back 9 percent, as all the structure types except educational facilities experienced weaker activity. Healthcare facilities dropped 10 percent from its elevated May pace, although June did see groundbreaking for several large healthcare projects, such as a $520-million hospital expansion in Houston, Texas, a $230-million hospital in Lakeland, Florida and a $220-million hospital in Fremont, California. The amusement-related category dropped 21 percent, yet June did see the start of such projects as a $102-million sports arena upgrade in San Antonio, Texas and a $100-million expansion to the Anaheim Convention Center in Anaheim, California. Decreased activity in June was also reported for public buildings (courthouses and detention facilities), down 26 percent; churches, down 30 percent; and transportation terminals, down 66 percent. The educational facilities category in June increased 10 percent, supported by the start of these projects — the $345-million Museum of the Bible in Washington, D.C., a $300-million research facility at Massachusetts Institute of Technology in Cambridge, Massachusetts a $190-million science and health professions facility at Hunter College in New York. There were also several large high school construction projects that reached groundbreaking in June, located in Maple Valley, Washington ($110 million), Portland, Oregon ($97 million) and Winnetka, Illinois ($89 million).

At the six-month mark of 2015, nonresidential building increased 4 percent compared to a year ago. The commercial building group held steady with its year ago pace, aided by a substantial 41 percent increase for hotel construction but dampened by declines for stores, down 3 percent; office buildings, down 8 percent and warehouses, down 12 percent. The year-to-date decline for office buildings came as the result of the comparison to the first half of 2014 that included $2.3 billion for the office portion of the $2.5-billion Apple headquarters in Cupertino, California. If the Apple headquarters project is excluded, the office building category in the first half of 2015 would be up 12 percent. Over the January-June period of 2015, the top five office markets ranked by the dollar amount of new construction starts were the following — New York, New York; Seattle, Washington; Boston, Massachusetts; Washington, D.C. and Denver, Colorado. Office markets ranked 6 through 10 were the following — Austin, Texas; Portland, Oregon; Houston, Texas; Charlotte, North Carolina and Dallas-Ft. Worth, Texas. The manufacturing plant category in the first six months of 2015 was up 5 percent compared to last year, helped by the start of several large petrochemical plants in similarity to what took place during 2014. Going forward, the volume of petrochemical plant projects is expected to drop back during the second half of 2015. The institutional building group in the first half of 2015 was up 6 percent compared to last year, with educational facilities registering a 5 percent gain. Other year-to-date increases were reported for transportation terminals, up 58 percent; amusement-related projects, up 11 percent and churches, up 3 percent. Year-to-date declines were reported for healthcare facilities, down 1 percent and public buildings, down 17 percent.

To view the monthly summary of construction starts, click here.

Source: Dodge Data & Analytics.

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn!

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn! Search our job board for your next opportunity, or post an opening within your company.

Search our job board for your next opportunity, or post an opening within your company. Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.

Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.