CHICAGO, Ill. — A strong retail sector has helped drive 2016 U.S. construction activity with retail construction projects up 24.4 percent year-over-year. But overshadowing the good news is a cloud of economic uncertainty that has companies laser-focused on Lean budgeting and smart spending decisions. According to JLL’s latest report on nonresidential construction activity, U.S. construction employment grew 4.7 percent in the first quarter of 2016 over the first quarter of 2015, with many workers engaged on retail projects. Concerns about China’s steep economic deceleration, combined with a drop in U.S. gross domestic product from 1.4 percent in the fourth quarter of 2015 to 0.5 percent in the first quarter of 2016, have made companies reluctant to invest.

For now, the market for commercial construction remains active. The JLL report shows a strong first quarter with steady growth projected for second quarter. The office, industrial and retail sectors are very active as companies continue projects that broke ground a year or two ago. A hint of the economic clouds causing concern comes from a small decline in office construction starts.

“Developers and occupiers are proceeding with caution, but they continue to build and renovate,” explains Todd Burns, president, Project and Development Services, JLL Americas. “However, project sponsors today are thinking more strategically about development versus renovation. The best-managed companies have learned to keep their capital spend within about two percent of the plan by starting with a realistic budget, leveraging data and analytical platforms and putting the right skills together in a centralized project team.”

Key sectors to watch

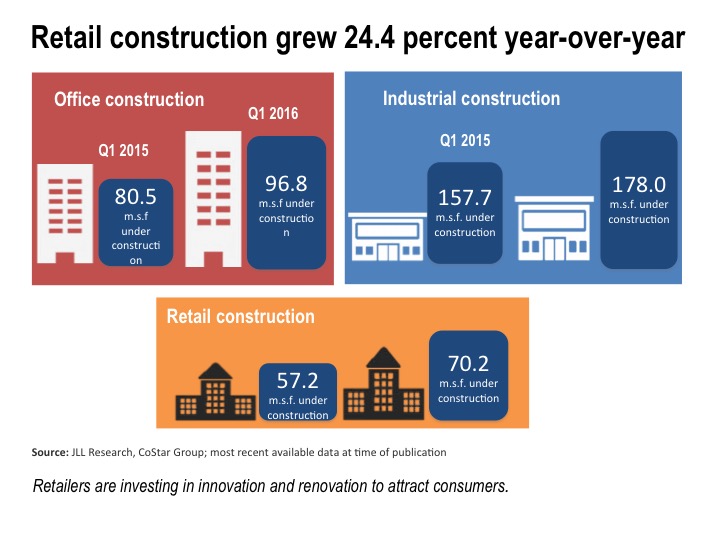

- Retail: Retail vacancies continue to decline, and retail has surged ahead of other property types in construction activity. Construction grew 24.4 percent year-over-year.

- Industrial: Industrial facility deliveries grew year-over-year in Q1 2016, reflecting the continuing strength in demand for modern industrial properties—much of it from retailers and e-commerce companies striving to meet changing consumer demand and service requirements. Construction grew 12.9 percent in Q1 2015 to Q1 2016.

- Office: Office building construction grew by 20.2 year-over-year, from 80.5 million square feet to 96.8 million square feet—but starts declined by 33 percent, from 20.3 million to 13.6 million, reflecting economic concerns and hesitancy to launch new projects.

“Retailers must innovate quickly to capture the untapped needs and expectations of consumers, who expect the same brand experience whether shopping online or in the brick-and-mortar store,” said Aaron Spiess, co-founder of Big Red Rooster, JLL’s multi-dimensional brand experience company. “If retailers wait too long to translate latent customer expectations into new stores or renovation programs, they may find that customers have become entrenched with competing brands and are not going to return.”

Another incentive to renovate, notes Spiess is a new federal tax break providing “safe harbor” for some remodeling expenses. Eligible retailers and restaurants can reduce 75 percent of qualifying expenses with the remaining 25 percent capitalized and depreciated over time.

Key markets to watch

- Nashville, Tennessee: The Southeast saw an uptick in office, industrial and retail construction in the last year. Nashville, in particular, has seen rapid construction growth and low vacancy rates as employers take advantage of the city’s low-cost, well-educated workforce.

- San Francisco, California: The Bay area is catching up to New York in construction costs, driven by high demand and high labor costs. San Francisco is on pace to exceed New York as the U.S.’ most expensive construction market in 2016.

- Dallas, Texas: As retailers followed population flows to Texas, Dallas has become one of the few markets that experienced retail development growth. Dallas was the most active retail market in Q1, up nearly 80 percent year over year.

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn!

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn! Search our job board for your next opportunity, or post an opening within your company.

Search our job board for your next opportunity, or post an opening within your company. Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.

Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.