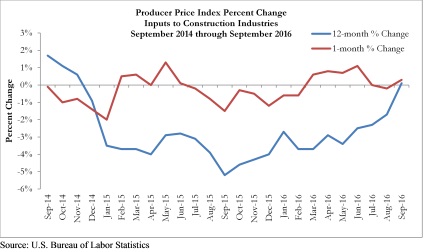

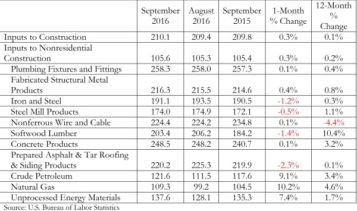

WASHINGTON, D.C. – Both nonresidential and overall construction input prices increased in September, with natural gas and crude petroleum prices bouncing back, according to analysis of the U.S. Bureau of Labor Statistics Producer Price Index released by Associated Builders and Contractors. The BLS data show that nonresidential input prices expanded 0.3 percent on a monthly basis in September, and overall construction prices also rose 0.3 percent on a monthly basis after declining 0.2 percent in August.

It is important to note that nonresidential input construction prices are now higher on a year-over-year basis for the first time since November 2014. Just four of the 11 key nonresidential construction input prices declined on a monthly basis, and only one—nonferrous wire and cable—experienced a year-over-year decline.

“The rise in material prices both on a monthly and year-over-year basis is not good news for U.S. nonresidential construction firms,” said ABC Chief Economist Anirban Basu. “For roughly two years, declining energy prices had wrung much of the inflation out of the economy, allowing interest rates to remain low and the Federal Reserve to remain fixated on guiding the nation toward full employment. Energy prices are no longer falling. Moreover, wage and healthcare inflation are building, which could drive interest rates higher next year. That scenario is not good for real estate valuations and nonresidential construction.

“Additionally, many contractors note that buyers of construction services continue to relentlessly pursue lower construction charges, even though many contractors are quite busy,” said Basu. “Labor and other costs are going up, and this has a tendency to squeeze margins. To the extent that materials prices begin to rise more forcefully, this could further compress nonresidential construction margins.

“The challenge for many contractors is to pass materials costs increases along to users of construction services in an effort to sustain margins,” said Basu. “Evidence suggests that this was not a major issue for construction firms prior to the Great Recession, but purchasers of construction services are now much less likely to accept significant cost inflation. The good news is that with the U.S. dollar strengthening recently, sharp month-over-month increases in many construction materials prices are unlikely in the near term.”

September Construction Input Prices

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn!

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn! Search our job board for your next opportunity, or post an opening within your company.

Search our job board for your next opportunity, or post an opening within your company. Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.

Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.