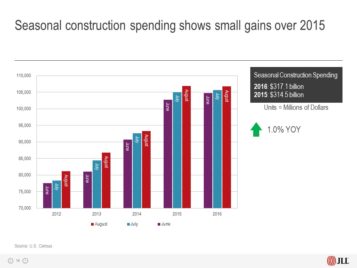

CHICAGO, Ill. – According to JLL’s latest report on United States construction activity, construction spending in 2016 has continued to hit cyclical highs, reaching $317 billion in the third quarter, a one percent growth increase year-over-year. While this may be the highest point this cycle, compared to past third quarter growth averages of 7-10 percent year-over-year, the small increase could indicate an impending slowdown.

A robust construction pipeline combined with rising building and materials costs and a shrinking labor pool could explain the lackluster growth. Materials costs have reached a 2.2 percent growth rate year-over-year, a five-year high, largely due to a high demand for lumber. Building costs as a whole have increased in the third quarter, seeing a slow but steady rate of 2.6 percent growth year-over-year.

A change in sight?

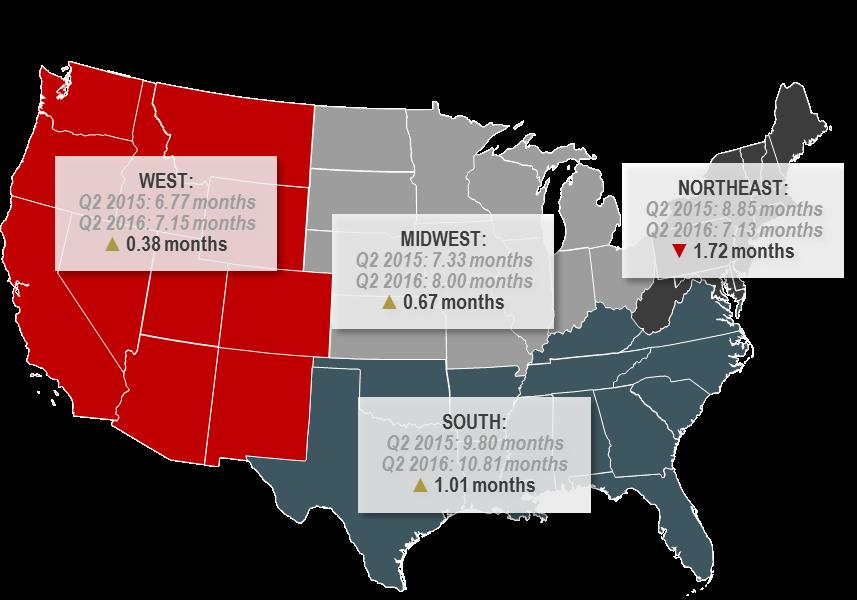

The Construction Backlog Indicator — a tool depicting the strength in the construction industry – shows a national average of more than eight months of work ahead for contractors. Over the course of 2017, U.S. markets can expect softening construction volumes as demand and market saturation begins to level out across property types.

Key themes impacting construction

- Economic uncertainty: Although U.S. construction volumes remain steady and growing, investors, financiers and contractors alike are beginning to approach decisions with caution, weighing risk and opportunity. Confidence indicators in the construction, development and lending industries are beginning to falter, depicting a changing mindset as tides begin to turn.

- Labor challenges: Record-breaking commercial construction activity along with a 4.5 percent construction unemployment rate – the lowest in over 14 years – has created a high-demand, low-supply scenario in terms of labor. As a result, the average hourly wage hit $29.98 per hour in July 2016, which is more than 3.5 percent higher than that of the year prior and outpaced the national average annual growth of 2.4 percent. With high construction volumes across property types and a dwindling labor pool, expect demand to remain elevated for the time being.

- Technology boom: Construction and development has made strides to become an industry for innovation with the implementation of new productivity software, tech products such as drones and virtual reality devices, and the ever expanding sharing economy making its debut in construction. Technology has become a game changer for project managers and contractors looking to streamline processes and offer an all-in-one solution.

Sector highlights

- Office: The office construction pipeline reached its highest point this cycle at 105.4 million square feet in Q3 2016, up 4.8 million square feet from last quarter. But starts declined by 10.6 million square feet this quarter, illustrating a possible hesitancy to begin new projects.

- Industrial: The growth rate of industrial new project deliveries continues to increase year-over-year, as the under construction pipeline remains steady at 204.3 million square feet. Vacancy continues to decline as the sector hits 5.8 percent – the lowest rate in over 16 years.

- Hospitality: Metrics for the U.S. hotel industry continue to suggest that the sector is stabilizing at normal levels. The supply pipeline has increased 1.5 percent year-to-date, but this growth remains below the long-term average of two percent.

- Retail: The retail under construction pipeline continues to climb, reaching 82.4 million square feet in Q3. Starts are at their highest in the Southwest region, boasting 6.7 million square feet in the last quarter.

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn!

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn! Search our job board for your next opportunity, or post an opening within your company.

Search our job board for your next opportunity, or post an opening within your company. Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.

Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.