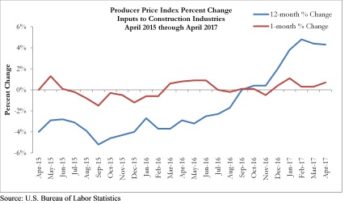

WASHINGTON, D.C. — Construction input prices rose for a fifth consecutive month in April, increasing by 0.7 percent on a monthly basis and 4.3 percent on a year-over-year basis, according to analysis of U.S. Bureau of Labor Statistics data released by Associated Builders and Contractors. Nonresidential construction input prices behaved similarly, increasing by .7 percent on a monthly basis and 4.2 percent on a year-ago basis.

Prices for final demand goods—the broadest measure supplied by producer price index data —increased by .5 percent in April on a seasonally adjusted basis. Final demand prices are up 2.5 percent on a year-over-year basis, the largest such growth since prices rose 2.8 percent on a year-over-year basis in February 2012. Fabricated structural metal products and iron and steel prices were the only inputs whose prices decreased from April. By contrast, natural gas and crude petroleum experienced brisk price increases, rising by 25.1 percent and 15.7 percent, respectively. The recent trend of falling oil prices is not fully reflected in the April data.

“The price increases from today’s report reinforce the recent growth in compensation costs, which means that the most advantageous period for purchasers of construction services is now well behind us,” said ABC Chief Economist Anirban Basu. “Today’s PPI report is particularly significant because it indicates that inflationary pressures continue to build within the U.S. economy.

“It is presumed by many analysts that the Federal Reserve will raise short-term interest rates next month in light of reasonably strong data, including data indicating that the official U.S. unemployment rate is now effectively at a 10-year low,” said Basu. “But even as short-term rates have risen, long-term rates have remained low. This supports construction activity by limiting the borrowing cost increases sustained by purchasers of construction services, whether private developers or public agencies. However, if the data continue to indicate growing inflationary pressures, lenders will be induced to raise rates, which could impact developer’s plans and compromise asset values. None of that is good for construction, all things being equal.

“The good news is that oil, copper, and other key input prices have been falling recently,” said Basu. “Much of this decline is yet to be reflected in the PPI data. The implication is that interest rate increases may only be gradual going forward, allowing for the nonresidential construction recovery to comfortably remain in place for the foreseeable future.”

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn!

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn! Search our job board for your next opportunity, or post an opening within your company.

Search our job board for your next opportunity, or post an opening within your company. Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.

Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.