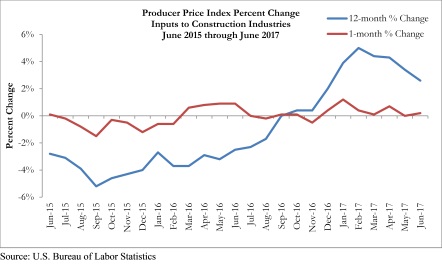

WASHINGTON, D.C. –Construction input prices rose .2 percent in June, according to an analysis of Bureau of Labor Statistics data released by Associated Builders and Contractors. This represents the sixth increase in construction input prices over the past seven months, but the overall rate of increase has been quite slow. On a year-over-year basis, construction input prices are up 2.6 percent.

Nonresidential construction input prices also rose .2 percent in June and are up 2.3 percent on a year-ago basis. Much of the input price inflation in June was due to increased charges for crude petroleum, which registered a price increase approaching 9 percent. However, that followed a 19.6 percent dip in May, and oil prices have been suppressed during the first two weeks of July.

Seven of eleven key inputs were associated with monthly increases in prices in June. Only softwood lumber prices, which fell 3 percent for the month, experienced a meaningful decline.

“There has been a lot of talk this year about a more robust and synchronized global economic recovery,” ABC Chief Economist Anirban Basu said. “Certainly, there has been some spectacular performance in financial markets this year, including in a number of emerging markets in the United States.

“However, underlying worldwide economic performance remains lackluster,” Basu said. “A number of significant emerging economies are struggling to generate average rates of growth by their own standards, including China, Brazil, Russia and South Africa. Add in the fact that America continues to grow around 2 percent and that Great Britain remains at elevated risk of recession, and the implication is that demand for productive commodities is not expanding briskly. Therefore, the modest rise in materials prices is precisely what one would expect to have transpired.

“This pattern is unlikely to change in the near-term. Central bank policy in much of the world remains accommodative. The world economy is growing and will continue to do so for the foreseeable future. But absent dynamic growth in the United States, Europe or China, there is little reason to believe that worldwide growth will accelerate meaningfully anytime soon. There is also an abundance of productive capacity, including in the global oil sector. Therefore, any increases in price have tended to trigger virtually immediate increases in energy production, which produces the seesaw pattern in prices that has been observed recently,” Basu said.

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn!

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn! Search our job board for your next opportunity, or post an opening within your company.

Search our job board for your next opportunity, or post an opening within your company. Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.

Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.