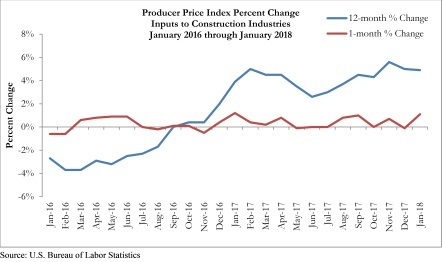

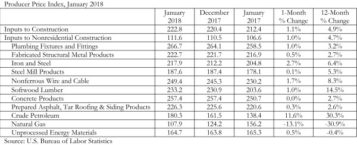

WASHINGTON, D.C. – Overall construction input prices increased 1.1 percent in January, reversing a slight decline in December 2017, according to a recently released Associated Builders and Contractors analysis of Bureau of Labor Statistics data. Compared to this time last year, overall construction materials prices are up 4.9 percent. Nonresidential construction materials prices are up 4.7 percent year over year and up 1 percent on a monthly basis.

The price of natural gas fell 13.1 percent in January and is down 31 percent on a year-over-year basis. In stark contrast, the price of crude petroleum rose 11.6 percent in January on a monthly basis and is 30.3 percent above its year-ago level. February has been different to date, with burgeoning U.S. production helping push down the price of oil.

“The expectation is that construction materials prices will generally edge higher during the course of 2018,” said ABC Chief Economist Anirban Basu. “After all, both domestic and global economies are strengthening, business and investor confidence is elevated, and construction backlog is rising. On top of that, the U.S. dollar has weakened in recent weeks, translating into more aggressive increases in the price of imports.

“One possible exception is oil. U.S. rig counts have been rising recently in response to North American oil prices that recently topped out at $65 per barrel,” said Basu. “Unlike producers in other parts of the world, American producers appear willing and able to respond quickly to price shifts. The implication is that if oil prices rise from current levels, America’s producers will respond quickly with additional supply and stabilize prices. This is precisely the dynamic that we have observed during the past several weeks.

“The typical contractor should expect materials price increases in the range of 5 percent this year. Larger increases are possible, but industry demand for materials will be constrained by growing skills shortages,” said Basu. “There is only so much output that America’s construction firms can deliver during any given period given workforce constraints, and those constraints serve to limit the demand for materials at any given moment.”

Visit ABC Construction Economics for the Construction Backlog Indicator, Construction Confidence Index and state unemployment reports, plus analysis of spending, employment, GDP and the Producer Price Index.

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn!

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn! Search our job board for your next opportunity, or post an opening within your company.

Search our job board for your next opportunity, or post an opening within your company. Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.

Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.