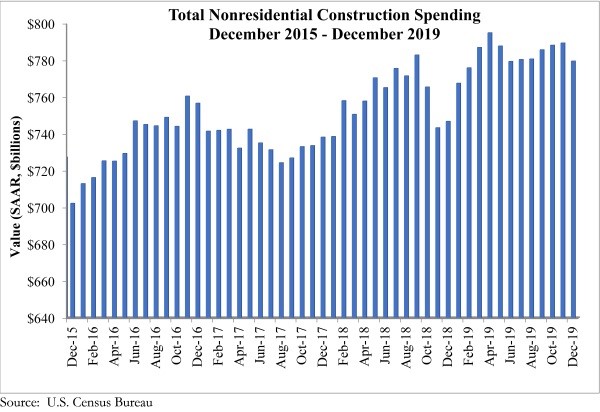

National nonresidential construction spending declined 1.2% in December 2019 but is up 4.4% on a year-ago basis, according to an Associated Builders and Contractors analysis of data published by the U.S. Census Bureau. On a seasonally adjusted annualized basis, spending totaled $779.6 billion in December.

Private nonresidential spending fell 1.8% on a monthly basis and is down by 0.1% compared to December 2018. Public nonresidential construction spending also slipped in December, falling 0.4% for the month. On a year-over-year basis, public nonresidential spending is up 11.2%.

“The transition from a private construction-led recovery to a public construction-led recovery is complete,” said ABC Chief Economist Anirban Basu. “During the years after the Great Recession, public construction waned as state and local governments struggled fiscally in the wake of diminished assessed property values, cautious consumers and slow income growth. Meanwhile, private construction was fueled by steady economic growth and a low cost of capital.

“But in recent years, private construction spending volumes have stopped growing, and in certain instances have been shrinking,” said Basu. “That was the situation in December, with nonresidential construction volumes in segments like commercial and lodging down on both monthly and year-ago basis. Spending on office construction, a category supported in part by the ongoing development of data centers, also slipped for the month.

“Meanwhile, improved state and local government finances continue to help perpetuate the public construction spending cycle,” said Basu. “With income tax collections rising as more people find jobs and secure raises, property tax collections having recovered and sales tax collections climbing in conjunction with consumer spending, there is more money available for many public priorities, including infrastructure. A majority of states raised gas taxes during the previous decade, generating even greater financial support for public construction. Accordingly, the infrastructure category of ABC’s Construction Backlog Indicator has been elevated in recent months, ABC’s Construction Confidence Indicator shows that contractors remain upbeat, and many public segments have experienced double-digit growth in construction spending during the past 12 months for which data are available, including highway/street, water supply and public safety.”

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn!

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn! Search our job board for your next opportunity, or post an opening within your company.

Search our job board for your next opportunity, or post an opening within your company. Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.

Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.