According to a recent report released by PSMJ Resources, proposal activity for architecture, engineering and construction firms sank to its lowest quarterly level in over a decade in the 2nd quarter of 2020, as the coronavirus-related downturn trimmed backlog and reduced revenue for firms coast to coast. PSMJ Resources’ Quarterly Market Forecast reported a near-record-low net plus/minus index of -22% for proposal activity in the latest quarter, substantially down from the +17% recorded in the 1st quarter.

Backlog slid from an NPMI of +6% in the 1st quarter to -24% in the 2nd, while the revenue NPMI dropped from +9% to -16%. On a positive note, projected revenue for the 3rd quarter jumped to -5% from -49%, meaning that about as many firms expect an increase in 3rd quarter revenue as expect a decrease. In the prior survey, almost two-thirds of A/E/C leaders anticipated lower revenue in April through June than they collected in the year’s first three months, while only about 15% projected growth.

The NPMI expresses the difference between the percentage of firms reporting an increase in proposal activity and those reporting a decrease. PSMJ’s QMF has proven to be a solid predictor of construction market health for the A/E/C industry since its inception in 2003.

“We’re clearly still a long way from being out of the woods,” says Greg Hart, a PSMJ consultant and the QMF’s director. “This is the third-lowest quarterly NPMI for proposal activity in the 17-year history of our survey, and while some of the markets and submarkets have remained relatively healthy, most are still struggling. We’re seeing improvement, but with proposal activity this depressed, the A/EC industry is likely to experience an uneven recovery for at least the next several months.”

Of the 12 major A/E/C markets measured by the QMF, water/wastewater has held up best during the COVID-19 crisis. Its 2nd quarter NPMI of 20% topped all major markets and was one of only four in positive territory. Water/wastewater also led all major markets in the monthly surveys that PSMJ conducted for April and May, and all six of its submarkets recorded a 2nd quarter NPMI above zero.

Energy/utilities (15%) was runner-up, followed by healthcare (10%) and surprisingly housing (2%). In the 1st quarter, housing (-19%) was among the hardest hit. The 2nd quarter survey reported substantial rebounds for single- and multi-family residential properties.

Proposal activity for the environmental market was flat (0%), but an improvement over its 1st quarter performance (-5%). Light industry’s NPMI was also 0% (up from -5%), while heavy industry fell from -17% in the 1st quarter to -26% in the 2nd. Transportation slid from +7% to -10%, government buildings dipped from -8% to -13% and education continued its weak showing with a fall from -12% to -30%.

Commercial markets continue to be battered, but showed slight improvement in the 2nd quarter. Proposal activity in the commercial developer market improved from -47% to -37%, while the commercial user market eased up from -51% to -45%.

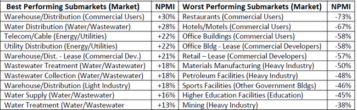

Among the 58 submarkets tracked, only 16 showed positive NPMIs (down from 20 in the 1st quarter). The highest NPMI among submarkets came from warehouse/distribution facilities for users at 30%. It was followed by water distribution (28%), and utility distribution and telecom/cable (both 22%). The restaurant submarket again performed worst, up slightly to -73% from -75%, closely followed by hotels/motels at -67%.

Discouraging signs among submarkets include the fact that none of the six transportation submarkets cracked 0% after half were in the positive in the first quarter, and only one healthcare submarket (medical labs) was positive after strong performances from all four submarkets in the 1st quarter.

PSMJ has been using the QMF as a measure of the design and construction industry’s health every quarter for the past 17 years, assessing the results overall and across 12 major markets and 58 submarkets. The company chose proposal activity because it represents one of the earliest stages of the project lifecycle. A consistent group of over 300 firm leaders responds each quarter, including 171 for the most recent quarter.

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn!

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn! Search our job board for your next opportunity, or post an opening within your company.

Search our job board for your next opportunity, or post an opening within your company. Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.

Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.