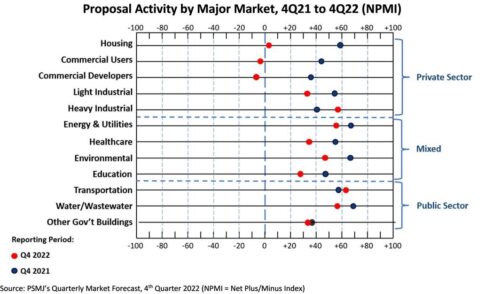

PSMJ’s latest Quarterly Market Forecast survey of 115 A/E/C executives (collected between Dec. 28 and Jan. 10) revealed an overall proposal activity Net Plus/Minus Index value of just 8. Any NPMI value above zero indicates that more respondents are seeing an increase in proposal activity compared to the prior quarter (+100 indicates all respondents are seeing an increase in proposal activity, -100 indicates all respondents are seeing a decrease in proposal activity). Since proposal activity is a leading indicator for backlog, revenue, and — ultimately — cash flow, the latest NPMI values provide a valuable glimpse into cash flow over the next 12-24 months.

This latest index value marks a continued decline from the record-setting 2022 Q1 value of 60.2 and a significant slide from the previous quarter value of 25.

Any index value greater than 20 generally indicates a healthy market. Three of the 12 client markets are now below that threshold and the two commercial markets have entered negative territory.

The following chart compares the NPMI values in each client to the same period last year:

The top five markets for the fourth quarter of 2022 are:

- Transportation: 62.9

- Heavy industry: 57.9

- Water/wastewater: 57.1

- Energy/utilities: 55.2

- Environmental: 46.2

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn!

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn! Search our job board for your next opportunity, or post an opening within your company.

Search our job board for your next opportunity, or post an opening within your company. Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.

Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.