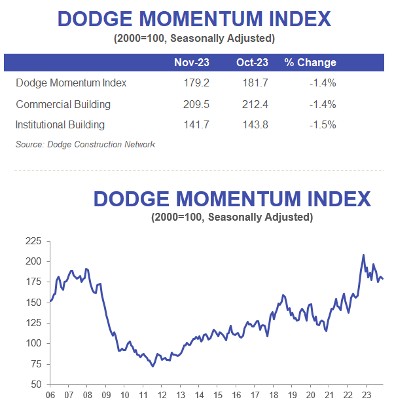

The Dodge Momentum Index , issued by Dodge Construction Network, decreased 1% in November to 179.2 (2000=100) from the revised October reading of 181.7. Over the month, the commercial and institutional components both fell 1%.

“While both portions of the Momentum Index saw slower momentum in planning, overall levels remain steady and will support construction spending in 2024 and 2025,” stated Sarah Martin, associate director of forecasting for DCN. “Nonresidential planning activity will remain constrained from stronger growth amidst ongoing labor and construction cost challenges.”

Excluding data center activity, all commercial segments saw declines in November. On the institutional side, more momentum in healthcare and public projects was offset by continued weakness in education planning. Year over year, the DMI was 14% lower than in November 2022. The commercial segment was down 20% from year-ago levels, while the institutional segment was up 2% over the same time period.

A total of 17 projects valued at $100 million or more entered planning in November. The largest commercial projects include the $480 million Project Cosmo Data Center in Cheyenne, Wyoming, and the $300 million Sherwin Williams Headquarters Building in Cleveland, Ohio.

The largest institutional projects include the $315 million phase two of the FSU Health Hospital in Tallahassee, Florida and the $258 million LA Convention Center Exhibition Hall in Los Angeles, California.

The DMI is a monthly measure of the value of nonresidential building projects going into planning, shown to lead construction spending for nonresidential buildings by a full year.

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn!

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn! Search our job board for your next opportunity, or post an opening within your company.

Search our job board for your next opportunity, or post an opening within your company. Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.

Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.