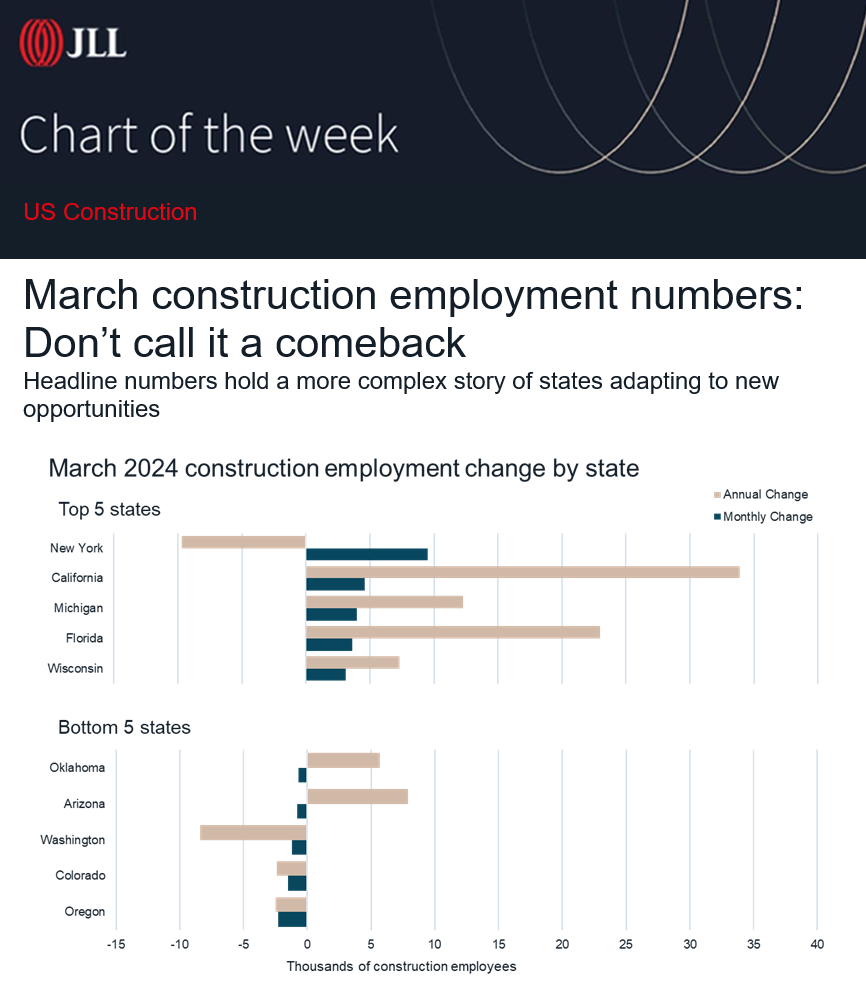

In March, the U.S. construction industry added a whopping 39,000 jobs, roughly double the average pace over the past few years and defying expectations of an already stretched-thin labor force. However, the construction industry remains highly localized and the where is extremely important when it comes to getting any project over the finish line. The distribution of gains by state reveals much about the industry’s needs and direction.

- New York outperformed all other states by a significant margin, accounting for roughly a quarter of total job gains (+9,500). While this growth reversed a sharp downturn from last month, the state’s construction employment is nevertheless down year-over-year by another roughly 10,000 jobs. New York has yet to recover to pre-pandemic employment levels but has about $51 billion in semiconductor manufacturing from Global Foundries, Micron and IBM to build along with another $30+ billion in other public and private investments announced.

- The mix of investments in the construction pipeline varies significantly, leveraging the unique strengths and opportunities in each of the top gaining states. Compared to New York and Michigan’s private manufacturing heavy pipelines, California, Florida, and Wisconsin skew toward public infrastructure.

- While positive overall, March’s hiring numbers highlight that the industry’s recovery trajectory and its future employment needs are far from uniform. The industry’s need to grow in anticipation of new opportunities in a changing economy however, is.

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn!

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn! Search our job board for your next opportunity, or post an opening within your company.

Search our job board for your next opportunity, or post an opening within your company. Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.

Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.