NEW YORK N.Y. — At a seasonally adjusted annual rate of $490.2 billion, new construction starts in August advanced 2 percent relative to July, it was reported by McGraw Hill Construction, a division of McGraw Hill Financial. Residential building stayed on the upward track, and nonbuilding construction (public works and electric utilities) rebounded after its loss of momentum in July. At the same time, nonresidential building retreated from its improved July amount, continuing the up-and-down pattern that’s been present during 2013. For the first eight months of 2013, total construction starts on an unadjusted basis came in at $329.4 billion, up 1 percent from the same period a year ago. If electric utilities are excluded from the year-to-date statistics, total construction starts in the first eight months of 2013 would be up 10 percent.

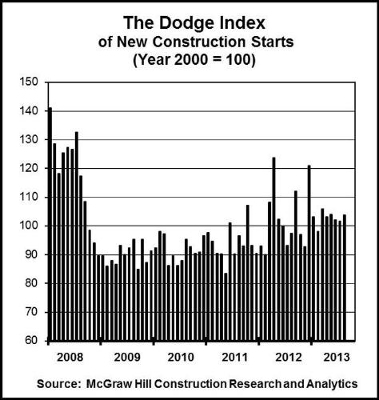

The August data lifted the Dodge Index to 104 (2000=100), compared to a revised 102 for July. So far during 2013, the Dodge Index has hovered within the range of 98 to 106, after averaging 103 for the full year 2012. “On balance, the construction industry is showing modest growth in 2013, although by major sector there’s been divergent behavior,” stated Robert A. Murray, vice president of economic affairs for McGraw Hill Construction. “Housing continues to lead the way, with consistent gains reported for both single and multi-family housing. Public works has edged up slightly from last year, helped by the start of several very large projects and withstanding for now the negative impact of the sequester. New electric utility starts have fallen substantially from last year’s record volume. However, it’s been more problematic to discern this year’s trend for nonresidential building — the commercial categories are hesitantly picking up the pace, but the institutional categories are still languishing. A more solid expansion for total construction requires a greater contribution from nonresidential building, which has yet to occur.”

Nonresidential building in August dropped 8 percent to $148.9 billion (annual rate), falling back after a 9 percent gain in July. Much of the downturn came from the institutional categories, which fell a combined 16 percent. Healthcare facilities pulled back 44 percent after showing improved activity in July, as construction is being restrained by several factors, including uncertainty related to the implementation of the Affordable Care Act and a greater number of hospital mergers. The largest hospital project that reached groundbreaking in August was a $118-million hospital in Shiloh Ill., followed by a $66-million addition to a medical center in Plano, Texas. Education-related construction in August dropped 5 percent, also after showing improved activity in July. There were several large high school construction projects that reached groundbreaking in August, including a $100-million high school in Haslet, Texas and a $62-million high school in Guilford, Conn., but these were not enough to avert a decline for the overall category. Most of the smaller institutional categories showed reduced contracting in August. Transportation terminal work dropped 50 percent from its heightened July amount, although August did include $157 million for a passenger rail station reconstruction in Harrison, N.J. The public buildings category in August retreated 35 percent, while church construction stayed depressed with a 14 percent decline. Amusement and recreational work ran counter to the generally downward movement for institutional building in August, climbing 57 percent. Large projects that helped to lift the amusement total were the $126-million Harrah’s Resort meeting facility in Atlantic City, N.J., a $101-million addition to the Hard Rock Casino and Hotel in Sioux City, Iowa and a $100-million renovation to the Inglewood Forum in Inglewood, Calif.

The commercial categories in August grew a combined 3 percent. Office construction increased 10 percent, lifted by the August start of several large projects — the $500-million Facebook data center in Altoona, Iowa, a $100-million addition/renovation to an office building in Rockville, Md. and a $91-million biomedical office building in New Haven, Conn. Hotel construction in August climbed 23 percent, rebounding from a weak July with the boost coming from groundbreaking for a $95-million hotel resort in Hollywood, Fla. Warehouse construction in August advanced 3 percent, but store construction fell back 9 percent, despite the start of an $85-million regional shopping center in northern Virginia. The manufacturing plant category in August grew 21 percent after a weak July, helped by the start of a $138-million chemical plant in Louisiana and a $130-million ethanol plant in North Dakota.

The 1 percent gain for total construction starts on an unadjusted basis for the first eight months of 2013 was due to varied behavior by the three main construction sectors. Residential building climbed 27 percent year-to-date, with single family housing up 30 percent and multi-family housing up 19 percent. Nonresidential building was down a modest 3 percent year-to-date, as the result of this pattern by major segment — commercial building, up 10 percent; institutional building, down 9 percent and manufacturing building, down 14 percent.

By geography, total construction starts in the January-August period of 2013 showed gains in four regions — the Northeast, up 9 percent; the West, up 6 percent; the South Central, up 4 percent and the Midwest, up 2 percent. The South Atlantic was the one major region to report a year-to-date decline, falling 13 percent as the comparison was against the first eight months of 2012, which included the start of two large nuclear power facilities. If electric utilities are excluded from the year-to-date construction start statistics in the South Atlantic, then that region would register a 17 percent gain.

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn!

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn! Search our job board for your next opportunity, or post an opening within your company.

Search our job board for your next opportunity, or post an opening within your company. Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.

Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.