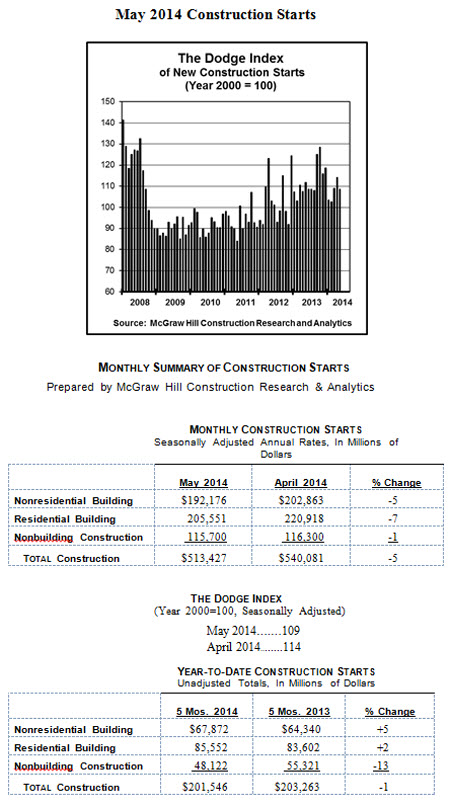

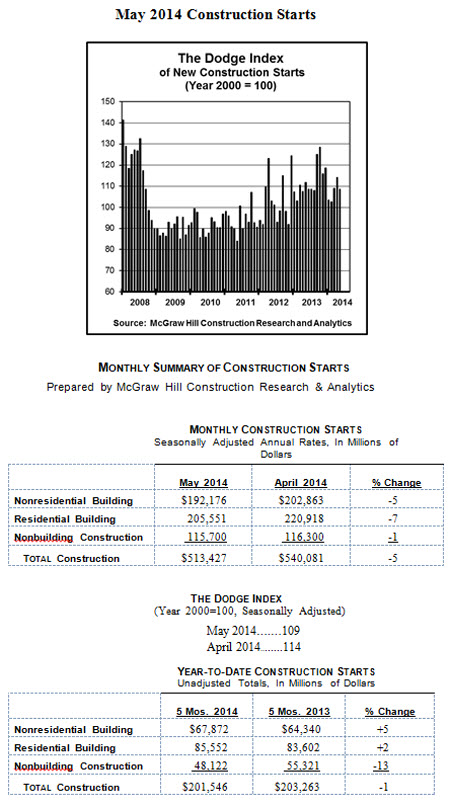

The May statistics lowered the Dodge Index to 109 (2000=100), compared to a revised 114 for April. During the first two months of 2014, the Dodge Index was reported at 103.

The May statistics lowered the Dodge Index to 109 (2000=100), compared to a revised 114 for April. During the first two months of 2014, the Dodge Index was reported at 103.

“After the slow beginning to 2014, construction activity during March and April regained upward momentum, and May's retreat does not necessarily mean that renewed expansion is stalling,” stated Robert A. Murray, chief economist for McGraw Hill Construction. “The downturn for nonresidential building in May was the result of a sharp pullback by the often-volatile manufacturing plant category after its huge gain in April. Residential building has often reflected the monthly up-and-down pattern for multifamily housing, which despite a setback in May can still be viewed as trending upward. Of more concern for residential building is single-family housing, which has yet to move beyond its recent plateau and resume growth. Non-building construction in May was pulled down by further weakness for electric utilities; at the same time, public works construction made a partial rebound in May after retreating during the previous two months.”

Nonresidential building in May fell 5 percent to $192.2 billion (annual rate), sliding back following a 15 percent jump in April. Manufacturing plant construction in May plunged 87 percent after being lifted in April by the start of several large projects, including a $3.0-billion ethylene plant in Texas. In contrast, the largest manufacturing project reported as a May start was an $80-million manufacturer-owned research laboratory in New Jersey. If the manufacturing category is excluded, nonresidential building would have been essentially flat in April followed by a 20 percent gain in May. Commercial building showed particularly strong growth in May, climbing 31 percent, led by gains for offices and hotels. Office construction in May surged 94 percent, led by the start of the massive new headquarters for Apple Inc. in Cupertino, California, with $2.3 billion estimated for the office portion of the project's $2.5-billion construction cost. Other large office projects that reached the construction start stage in May included a $130-million data center in Elk Grove, Illinois, and a $56-million office building in San Diego, California. Through the first five months of 2014, the top five metropolitan areas ranked by the dollar volume of new office starts were — San Jose, California, New York, New York, Houston, Texas, Washington D.C. and Boston, Massachusetts. Hotel construction in May increased 101 percent, boosted by the start of two large projects — the $272-million Marriott Marquis Hotel in Houston, Texas, and the $260-million Cleveland Convention Center Hotel in Cleveland, Ohio. After showing improved activity in April, both stores and warehouses retreated in May, falling 23 percent and 21 percent, respectively.

The institutional side of nonresidential building increased 11 percent in May, helped by substantial gains for several smaller institutional structure types. The public buildings category jumped 144 percent, lifted by the start of the $396-million San Diego County Central Courthouse in San Diego and the $200-million Stockton Courthouse in Stockton, California. The transportation terminal category increased 81 percent, led by $208 million for work on the East 86th Street Station on the Second Avenue Subway Line in New York. The amusement-related category advanced 17 percent, but church construction dropped 7 percent. The largest institutional category, educational buildings, edged up 1 percent in May, supported by groundbreaking for such projects as a $98-million high school in Manassas, Virginia, and a $79-million high school in Leander, Texas. Healthcare facilities in May slipped 5 percent, although the latest month did include groundbreaking for several large hospital projects, located in Huntley, Illinois ($210 million), Barrington, Illinois ($150 million) and Mansfield, Texas ($118 million).

Nonbuilding construction in May slipped 1 percent to $115.7 billion (annual rate). A 31 percent decline for electric utilities slightly outweighed a 5 percent increase for public works overall, pulling down May's non-building total. The largest electric utility projects that were entered as May starts were a $335-million wind farm in Kansas, a $200-million expansion of a gas-fired power plant in Alaska and a $112-million gas-fired power plant in Louisiana. For public works, substantial increases in May were reported for highways, up 23 percent, and bridges, up 34 percent—after particularly weak activity was reported for both project types during April. Large bridge projects that were entered as May starts included a $146-million bridge renovation in Albany, New York and a $132-million bridge replacement in Kentucky. The top five states for highway and bridge construction during the first five months of 2014 were Texas, California, Pennsylvania, Illinois and North Carolina. The miscellaneous public works category, which includes a diverse set of project types, jumped 72 percent in May, led by $294 million for rail-related site work near Grand Central Station in New York City, a $237-million natural gas pipeline in Mississippi and $118 million for paving and runway work at LaGuardia Airport in New York City. The environmental public works categories registered declines in May from the previous month, with sewers down 22 percent, water supply systems down 25 percent and river/harbor development down 52 percent.

The 1 percent drop for total construction starts on an unadjusted basis during the first five months of 2014 relative to last year reflected modest gains for nonresidential building and housing, combined with a double-digit slide for non-building construction. Nonresidential building during the January-May period climbed 5 percent, resulting from increases for manufacturing buildings, up 52 percent; and commercial buildings, up 5 percent, while the institutional building segment slipped 2 percent. Residential building during the first five months of 2014 grew 2 percent, with multifamily housing up 10 percent while single-family housing was flat. Non-building construction in the first five months of 2014 was down 13 percent, with public works falling 8 percent while electric utilities plunged 35 percent. By geography, total construction starts during the first five months of 2014 showed growth in the Northeast and South Central, each up 6 percent. The other three regions registered year-to-date total construction declines—the West, down 2 percent; the Midwest, down 4 percent and the South Atlantic, down 8 percent.

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn!

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn! Search our job board for your next opportunity, or post an opening within your company.

Search our job board for your next opportunity, or post an opening within your company. Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.

Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.