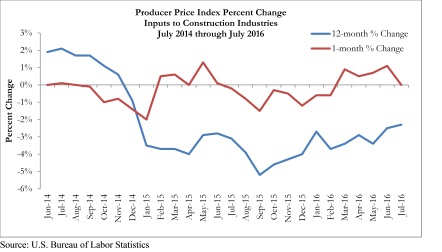

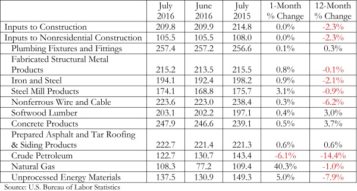

WASHINGTON, D.C. – Nonresidential construction input prices were unchanged in July according to a recent analysis of the Bureau of Labor Statistics Producer Price Index released by Associated Builders and Contractors. Input prices for both the nonresidential construction segment and construction as a whole are 2.3 percent lower than they were a year ago.

“ABC has been predicting relative stability in input prices, and that is precisely what July’s report delivered,” said ABC Chief Economist Anirban Basu. “A weak and disappointing global economy has not been able to drag prices higher. Persistently low prices have placed a lid on the quantity supplied in many input categories, which has helped prevent widespread materials price declines recently. The result has been that many input prices have remained within a tight range after a period of remarkable volatility.

“With construction labor costs rising more rapidly in much of the country, including in quickly growing communities in the southeast and Pacific northwest, the stability in materials prices takes on greater importance from a profit margin perspective,” said Basu. “The pace of nonresidential construction spending is no longer expanding as it had been during prior years. With demand no longer expanding briskly, construction firms may have greater difficulty passing cost increases along to purchasers of services. Unexpected increases in materials prices could therefore place significant downward pressure on industry margins.

“However, a sharp increase is unlikely as the forces that have resulted in relative input price stability recently remain in place,” said Basu. The global economy will post another disappointing year in 2016. The U.S. dollar continues to be stable relative to most currencies, which will also help suppress sharp materials’ price increases.”

Among 11 key inputs to the delivery of construction services in the U.S., only crude petroleum experienced a monthly price decline. Crude petroleum has a disproportionate impact on the producer price index, however. By contrast, natural gas prices surged 40.3 percent for the month, with the input’s index value rising from 77 in June to 108 last month.

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn!

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn! Search our job board for your next opportunity, or post an opening within your company.

Search our job board for your next opportunity, or post an opening within your company. Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.

Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.