By Todd Burns

The year began with decreased construction starts, affected in part by oil prices. Depressed oil prices have rippled through the major North American energy hubs, driving industry consolidation and reducing demand for real estate from energy companies. The sudden fall in prices in the recent months and the contraction of drilling activity have stressed the entire energy industry, especially for land-based exploration, drilling and supply companies. This kind of energy industry contraction reduces real estate demand and, therefore, construction starts, in energy-dominated cities like Houston, Texas, Calgary, Alberta Canada and Denver, Colorado.

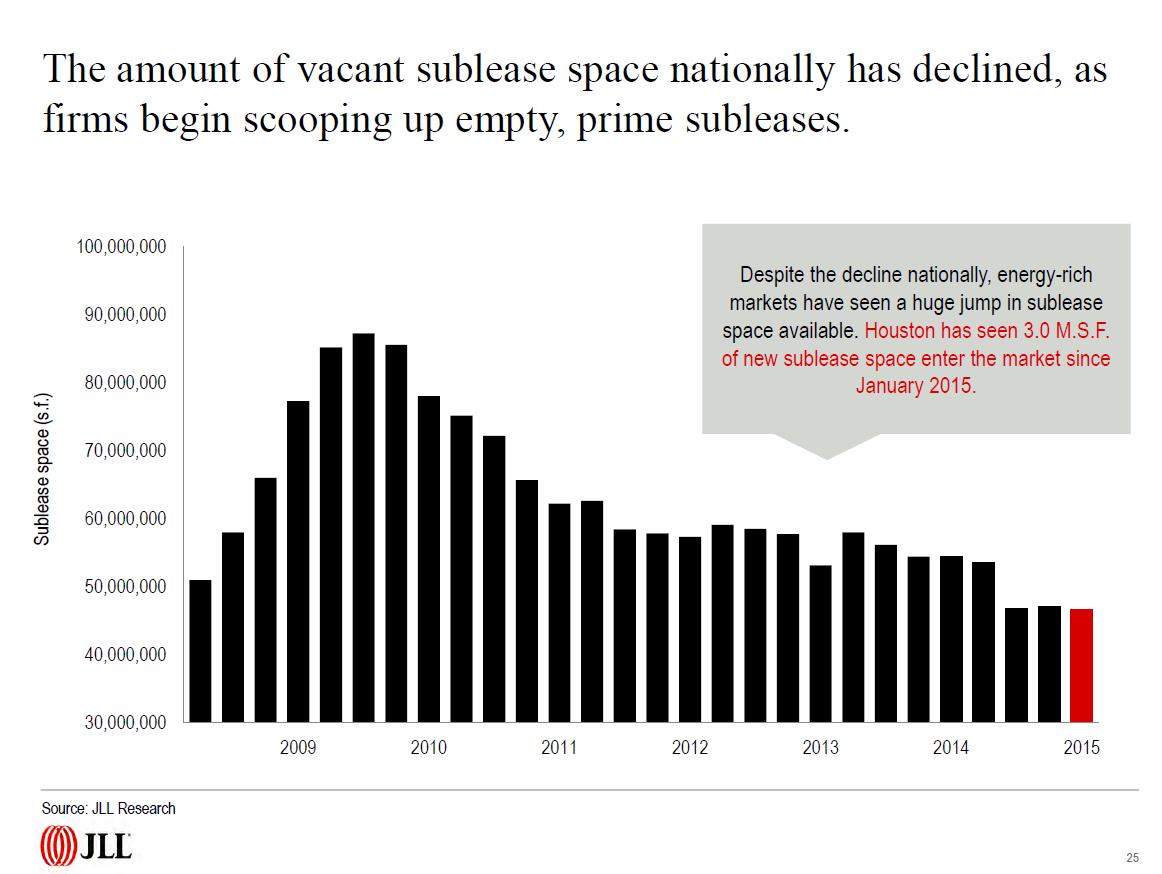

Although Houston is still the nation’s leader in terms of square footage under construction, this market has been hit the hardest and construction has slowed. With subleases pouring onto the market, vacancy is high, particularly in the “energy corridor.” While this is difficult news for developers and construction firms, the silver lining is that it creates opportunities for tenants to move into new, premium space—space that was unavailable during the boom of recent years. As mergers and acquisitions move employee groups around the area, it could also spell opportunities for office interiors construction, as consolidation plays out within existing buildings.

Declining demand runs the risk of stifling the need for new space in cities like Denver and Calgary, where smaller industrial projects are dominating market activity. But even so, there is an expected increase in industrial rental rates in Houston and Denver as the market catches up with the vast amount of Class A product delivered in 2014 and the first quarter of 2015. So while new projects may not be starting, there are still plenty of cranes in the air.

Economic diversity opens more doors

The impact of oil prices is eased by growth in other industries within significant energy markets. Cities like Denver, and Pittsburgh, Pennsylvania, have certainly profited from their oil and gas concentrations—but they also have deep roots in many other industries, some of which are in growth mode. Forward-looking construction superintendents can take advantage of economic diversity by adopting a long-term view of which sectors offer growth as opposed to those that have seen a decline in construction starts. For many, that means shifting focus from the recent energy boom to traditional industries like financial services, or new opportunities like the technology sector.

All real estate is local — even when industries are global

Every city, every region and even sub-markets within those regions have their own market dynamics. For locations primarily driven economically by the energy industry, low oil prices are strongly correlated with lower rents. Places like Calgary, Houston and Fort Worth, Texas — not to mention production areas like Williston, North Dakota — will offer the most advantageous opportunities for good deals. And, despite construction starts suffering in those locations, there may be opportunity for renovations and interiors work, as construction volumes remain high. On the other hand, cities important to the energy industry but with more diversified economies — think Pittsburgh or Dallas — remain costly as non-energy industries are keeping real estate prices high.

Low gas prices typically drive an uptick in demand for retail, e-commerce and industrial real estate. Retail starts are up in Seattle, Washington, though they remain stagnant across the rest of the country. Retail companies are optimistic that 2015 will see more growth, thanks to increased consumer confidence. As oil prices decreased earlier this year, consumer confidence across the country increased, spurring firms to invest in growing warehouse and e-commerce space. For example, Phoenix, Arizona is a red-hot market thanks to outstanding economic growth and retail fundamentals recovery. As a result of declining oil prices, increasing employment and growing consumer confidence, retail and e-commerce demand is expected to spike, leading to amplified construction demand in these sectors.

Considering how much the oil prices affected construction starts earlier this year, and given the speed with which the North American energy industry can respond to changes in oil prices, it is likely that we will see a repeat of this cycle in the energy capitals of Houston, Calgary, Denver and others. However, the dip in the second quarter of 2015 because of winter weather and other supply factors is readjusting itself. Nationally, starts are finally building to reach their highest point since the recession. By looking at the markets, industries and regions seeing positive growth, such as Phoenix’s success in retail and Seattle’s office market, construction superintendents can focus on the positives to drive business.

Todd Burns is the president of the Project and Development Services and General Contracting units of JLL. He is responsible for establishing and executing the strategic direction of the business.

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn!

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn! Search our job board for your next opportunity, or post an opening within your company.

Search our job board for your next opportunity, or post an opening within your company. Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.

Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.