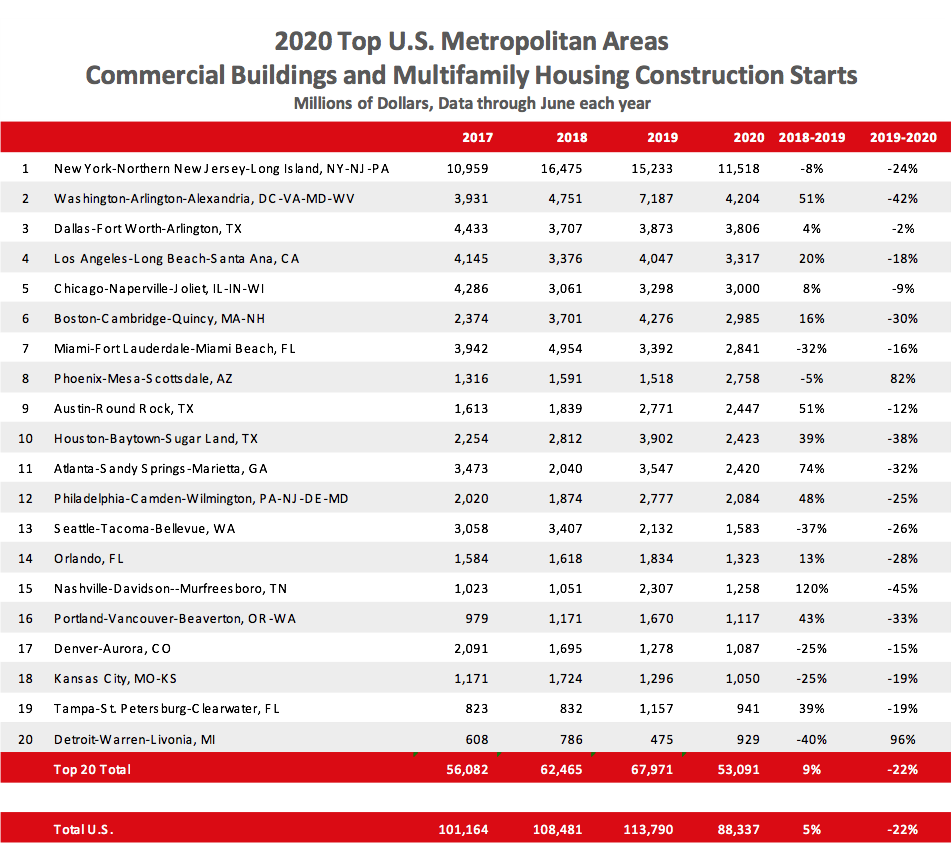

The COVID-19 pandemic and resulting recession have wreaked havoc on U.S. building markets. According to Dodge Data & Analytics, commercial and multifamily starts were quite healthy during January and February but stalled as the pandemic hit the nation in March. For the first three months of 2020, U.S. multifamily and commercial building starts inched up 1% from the same period of 2019. The commercial and multifamily group is comprised of office buildings, stores, hotels, warehouses, commercial garages and multifamily housing. Not included in this ranking are institutional building projects (such as educational facilities, hospitals, convention centers, casinos, transportation terminals), manufacturing buildings, single-family … Read more

Dodge Construction Starts Post Small Gain in May

Total construction starts rose 3% from April to May to a seasonally adjusted annual rate of $595.1 billion, following a 25% decline the previous month. Several large nonresidential building projects broke ground in May resulting in the gain. Removing those large projects from the statistics would have resulted in no change in starts over the month. In May, nonresidential buildings increased 8%, while residential building starts rose 4%. Nonbuilding starts, however, declined 4% during the month. Through the first five months of 2020, total construction starts were 12% lower than in the same period in 2019. Nonresidential starts were down … Read more

Construction Starts Show Sharp Contraction in April

Total construction starts declined 25% from March to April to a seasonally adjusted annual rate of $572.2 billion as COVID-19 and economic recession hit the construction sector. In April, nonresidential building starts fell 37% from March, while residential dropped 25%. The decline in nonbuilding construction starts was more tepid, falling just 5% due to strong activity in streets and bridges. On a year-to-date basis through four months of 2020, total construction starts were 8% lower than the same period in 2019. Nonresidential building starts were off 14%, while nonbuilding starts were down 15%. Residential starts, meanwhile, were up 2% on … Read more

March Construction Starts Surge 16 Percent

New construction starts in March advanced 16% from the previous month to a seasonally adjusted annual rate of $809.2 billion, according to Dodge Data & Analytics. The substantial gain followed a lackluster performance during the first two months of 2019, as total construction starts in March were able to climb back to a level slightly above the average monthly pace during 2018. The March data produced a reading of 171 for the Dodge Index (2000=100), up from 148 in February, and 1% higher than the full year 2018 average for the Dodge Index at 170. At the same time, the Dodge Index … Read more

New Construction Starts in December Decline 10%

NEW YORK, N.Y. – New construction starts in December fell 10 percent to a seasonally adjusted annual rate of $708.9 billion, continuing to retreat after November’s 7 percent slide, according to Dodge Data & Analytics. The December downturn reflected diminished activity for each of the three main construction sectors. Nonresidential building dropped 14 percent, as its commercial building segment lost momentum following its heightened November amount. Residential building pulled back 8 percent, due to reduced activity in December for both single-family and multifamily housing. Nonbuilding construction decreased 9 percent, with a steep plunge by the electric utility/gas plant category that … Read more

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn!

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn! Search our job board for your next opportunity, or post an opening within your company.

Search our job board for your next opportunity, or post an opening within your company. Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.

Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.