Total construction starts fell 27% in January to a seasonally adjusted annual rate of $865.6 billion, according to Dodge Construction Network. During the month, nonresidential building starts fell 38%, residential starts lost 20% and nonbuilding starts declined by 16%. Comparatively, total construction was 14% lower in January 2023 than in January 2022. Nonresidential building starts were down 2%, nonbuilding starts rose 10% and residential starts lost 34%. For the 12 months ending January 2023, total construction starts were 13% higher than the 12 months ending January 2022. Nonresidential starts were 36% higher, residential starts lost 6% and nonbuilding starts were … Read more

Construction Industry Outlook 2022 E-Book Available

After a challenging couple of years, the economy is on the mend. Growth is projected into 2022 as total starts are estimated to reach 6% to $946 billion. This e-book explores the following core sectors: • Residential construction: Single-family and multi-family housing • Commercial construction: Retail stores, warehouses, offices and hotels • Institutional building: Education, healthcare, transportation, recreation and public buildings • Manufacturing construction • Nonbuilding construction: Streets and bridges, environmental/ water public works, electric power/utilities and other non-building Get the latest forecasts and insights.

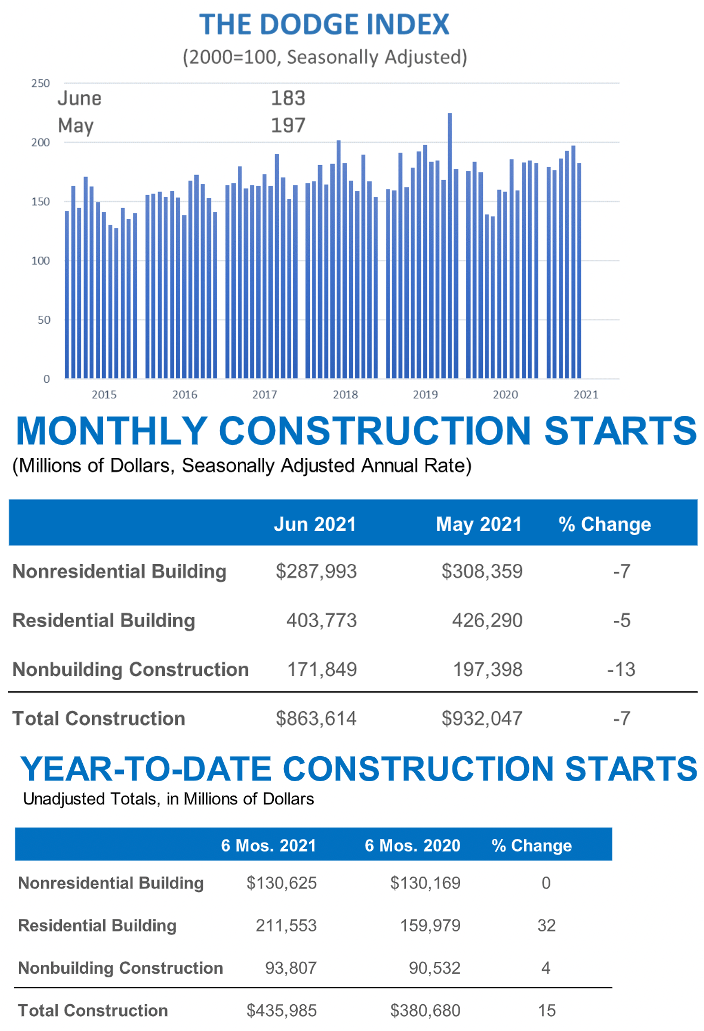

Total Construction Starts Slip in June

Total construction starts lost 7% in June, slipping to a seasonally adjusted annual rate of $863.6 billion, according to Dodge Data & Analytics. All three major sectors (residential, nonresidential building and nonbuilding) pulled back during the month. Single-family housing starts are feeling the detrimental effects of rising materials prices. Large projects that broke ground in May were absent in June for nonresidential building and nonbuilding starts, resulting in declines. “Unabated materials price inflation has driven a significant deceleration in single-family construction,” stated Richard Branch, chief economist for Dodge Data & Analytics. “Lumber futures have eased in recent weeks, but builders … Read more

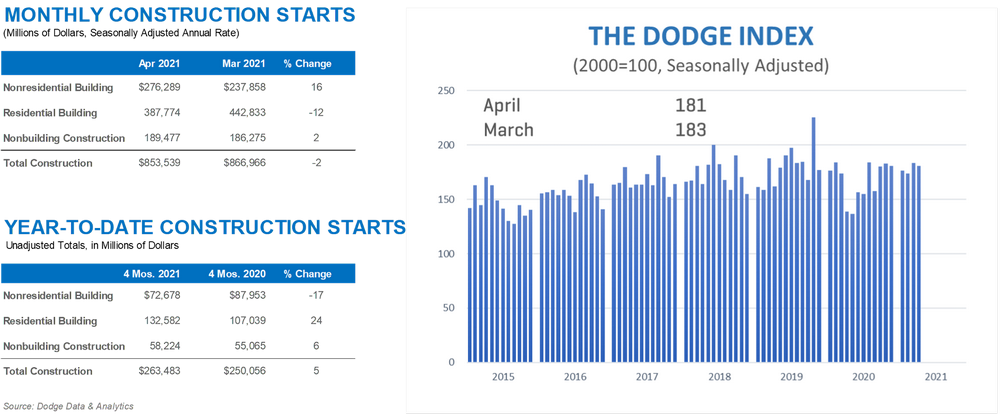

Dodge Data & Analytics Reports Construction Starts for Single-Family Decline, Nonresidential Gain

Total construction starts fell 2% in April to a seasonally adjusted annual rate of $853.5 billion, according to Dodge Data & Analytics. Single-family construction posted a sizeable decline following months of strong activity, while nonresidential building and nonbuilding starts both gained. “The pullback in single-family construction starts was inevitable after showing exceptional strength over the past year,” said Richard Branch, chief economist for Dodge Data & Analytics. “Higher material prices, supply shortages and a dearth of skilled construction labor were bound to catch up with housing and will ultimately limit the ability of this sector to show the same rate … Read more

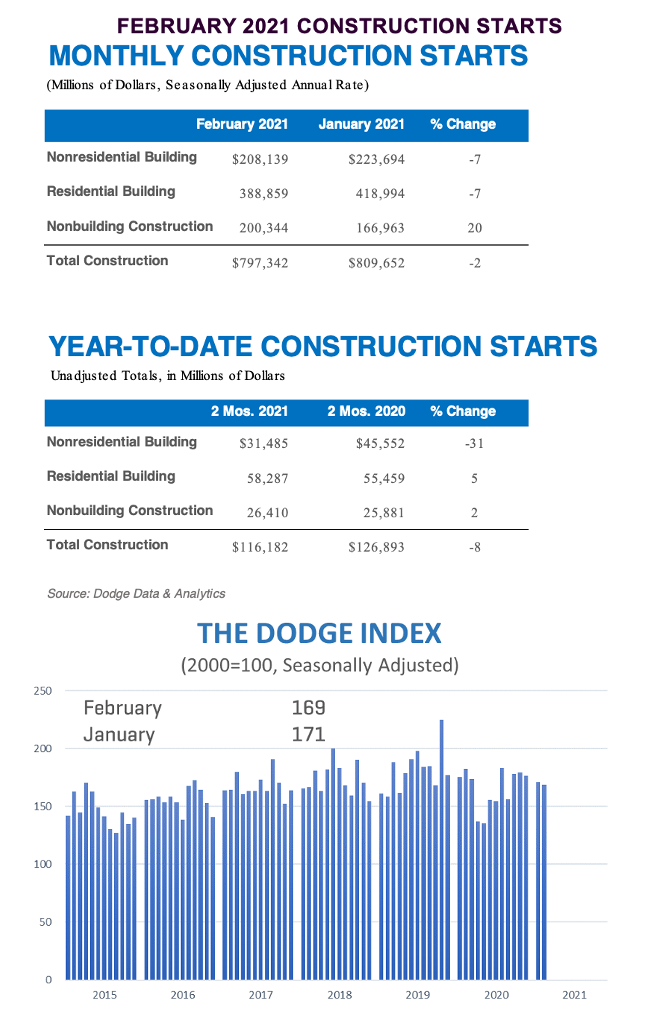

Dodge Data & Analytics Reports National Construction Starts Continue Decline in February

Total construction starts fell 2% in February to a seasonally adjusted annual rate of $797.3 billion. Nonbuilding construction starts posted a solid gain after rebounding from a weak January, however, residential and nonresidential building starts declined, leading to a pullback in overall activity. The Dodge Index fell 2% in February, to 169 (2000=100) from January’s 171. “With spring just around the corner, hope is building for a strong economic recovery fueled by the growing number of vaccinated Americans,” said Richard Branch, chief economist for Dodge Data & Analytics. “But the construction sector will be hard-pressed to take advantage of this … Read more

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn!

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn! Search our job board for your next opportunity, or post an opening within your company.

Search our job board for your next opportunity, or post an opening within your company. Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.

Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.